Midtown Economic Council

About the MEC

The MEC is organized as an affiliate board of Midtown Indy and is comprised of representatives appointed by five stakeholder organizations which serve a dozen neighborhoods in or near the North Midtown Economic Development Area.

These organizations include:

- Midtown Indy

- Mapleton-Fall Creek Development Corporation

- Butler Tarkington Neighborhood Association

- Meridian Kessler Neighborhood Association

- Broad Ripple Village Neighborhood Association

The MEC reviews projects within the Midtown Economic Development Area for potential TIF investment. Recommendations of the MEC are presented to the Indianapolis Metropolitan Development Commission (MDC) for consideration with requests for project and/or infrastructure investments using TIF dollars directly or through bond issuance.

- College Ave. streetscape railings

- College Ave. alleyway resurfacing

- 54th Street resurfacing and sidewalk improvements

- 42nd Street and Boulevard Place sidewalk improvements.

Questions about the Midtown TIF?

Objective of the MEC

In March of 2013, after more than four years of advocacy, the MEC and its partners secured the North Midtown Tax Increment Finance District, The MEC was formally recognized by the Indianapolis City-County Council in an advisory capacity related to the community’s interests in the North Midtown TIF and Economic Development Area. The Council charged the MEC with to making recommendations to the City-County Council and Metropolitan Development Commission related to the investment of TIF proceeds.

The MEC met with the City’s Metropolitan Development Commission (MDC) to share its guiding principles and seek the MDC’s cooperation in implementing the TIF over decades to come. The MEC pledged to develop clear goals and objectives (as well a process that would encourage projects) which were:

- Consistent with Transit Oriented Development (TOD) principles

- Transit supportive of residential density

- Urban in design/include an appropriate strategy for parking

- Mixed use

- Equitable in providing jobs, attracting residents, and benefiting existing residents and businesses

- Contributes to or enhances the public realm

| Organization | Primary Member | Alternate Member | Staff Member |

| Broad Ripple Village Association | Mark Demerly | Elizabeth Marshall | Colleen Fanning |

| Butler-Tarkington Neighborhood Association | Neil Bloede | Chris Meier | N/A |

| Mapleton Fall Creek Development Corporation | Tyson Domer | Doug Day | Leigh Riley Evans |

| Meridian Kessler Neighborhood Association | Matthew Dickerson | Nick Colby | Chelsea Marburger |

| Midtown Indy, Inc. | Jennifer Pyrz | Matt Brauer | Michael McKillip |

Midtown TIF | Tax Increment Financing District

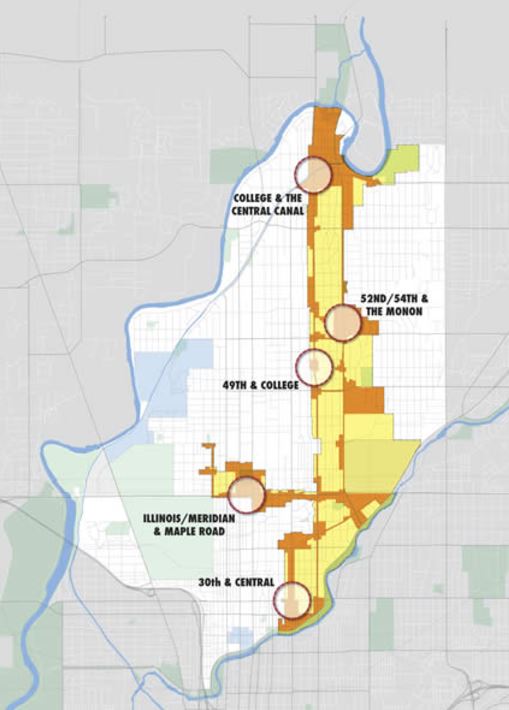

Stakeholders strategically selected areas or “nodes” to addresss both the specific challenges unique to each node, but also to realize the economic potential of each node for the district and city at large. While there are baseline common elements of vacancy, blight, and under utilization, each selected node has unique market challenges and offers unique opportunities to meet the diverse needs of Midtown’s neighborhoods. These considerations led stakeholders to identify five nodes to receive “priority” status inside of the TIF district.

The goal is “catalytic” development of the variety that is most likely to spur additional private investment.

Additional goals include increasing residential density and the concentration of mixed-use developments, and bringing vital services to adjacent neighborhoods. The term of the TIF, 25 years, meant that early investments must be carefully considered to ensure long-term performance.

The prescribed solution for each node varies in large part by market conditions or obstacles present in each node and the respective aspirations stakeholder groups have for their respective node(s). The overall strategy will link the selected nodes and their respective neighborhoods through the TIF. This allows generated tax increment to be shared throughout the district between stronger markets and weaker markets. The arrangement encourages bold market solutions, those which could flourish if barriers to development could be overcome.

Tax increment financing only captures increment or newly generated taxes from “new development” or “redevelopment” and not from the existing tax base. So projects which don’t generate tax income or which require subsidy greater than the increment they generate must be accompanied by projects which are net increment generators. Without projects that generate increment, the TIF is essentially useless as a tool because it would have no revenue to encourage development, or, the money would run out faster than generated. The value of the TIF is in its power to leverage market investment. Those investments and the revenue they generate are the key to increasing the tax base in the long run.

Subscribe to our Newsletter

© Midtown Indianapolis Inc. | Midtown Indy

3965 North Meridian Street, Suite G | Indianapolis, IN 46208